If I Haven T Filed Taxes In Years Do I Still Get A Stimulus Check

This group includes single filers who made under 12 200 and married couples making less than 24 400 in 2019.

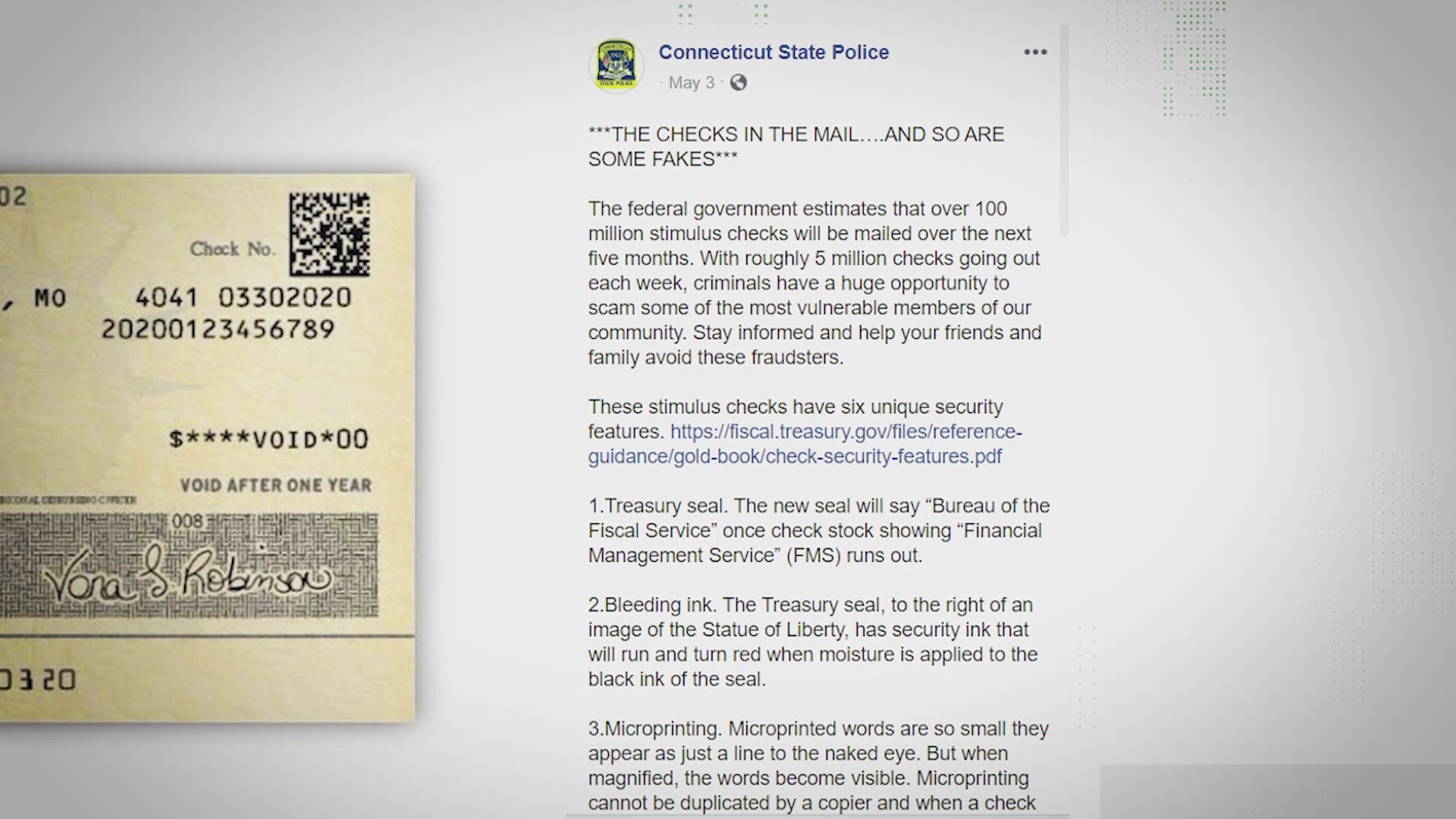

If i haven t filed taxes in years do i still get a stimulus check. The internal revenue service now offers a way to register for the program. Regardless of your reason for not filing a required return file your tax return as soon as possible. We have tools and resources available such as the interactive tax assistant ita and faqs. If you are not required to file a tax return you can still get a payment.

First if you haven t filed your taxes lately do it now. For each return that is more than 60 days past its due date they will assess a 135 minimum failure to file penalty. If you need help check our website. Those individuals still face an april 15 2020 to file their return.

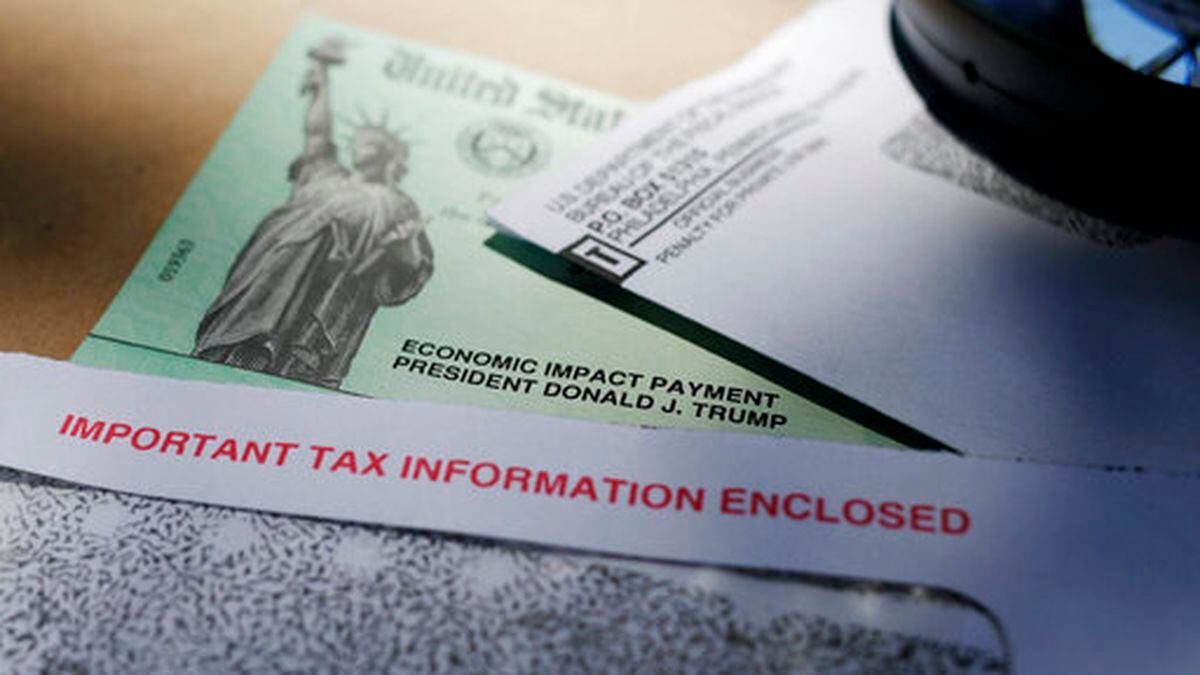

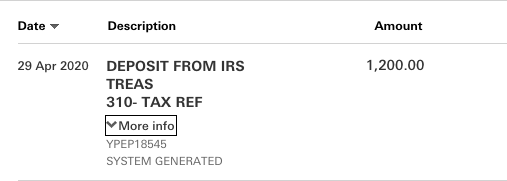

To get the 1200 stimulus check single 2400 married couple and 500 per child your 2018 or 2019 tax return will have to be filed unless your only income is social security disability ssi or at poverty level 12 000 or less in which you will get the 1200 check without filing a return. If you owed taxes for the years you haven t filed the irs has not forgotten. I don t own a home i have no investments. The irs also noted last week that more than 1 million people haven t filed tax returns for 2016 and are still owed a refund.

I haven 39 t file taxes since 2017 will i get a answered by a verified tax professional we use cookies to give you the best possible experience on our website. You weren t required to file a tax return in 2018 or 2019 if your adjusted gross income was. You haven t filed your federal income tax return for this year or previous years. The failure to file penalty also known as the delinquency penalty runs at a severe rate of 5 up to a maximum rate of 25 per month or partial.

Lower income americans who haven t filed a 2018 or a 2019 return because they are under the normal income limits for filing a tax return should use the irs s new web tool. I haven t filed taxes in over 10 years. My income is modest and i will likely receive a small refund for 2019 when i file. If you need a stimulus payment but haven t filed an income tax return lately help has arrived.